bank islam moratorium

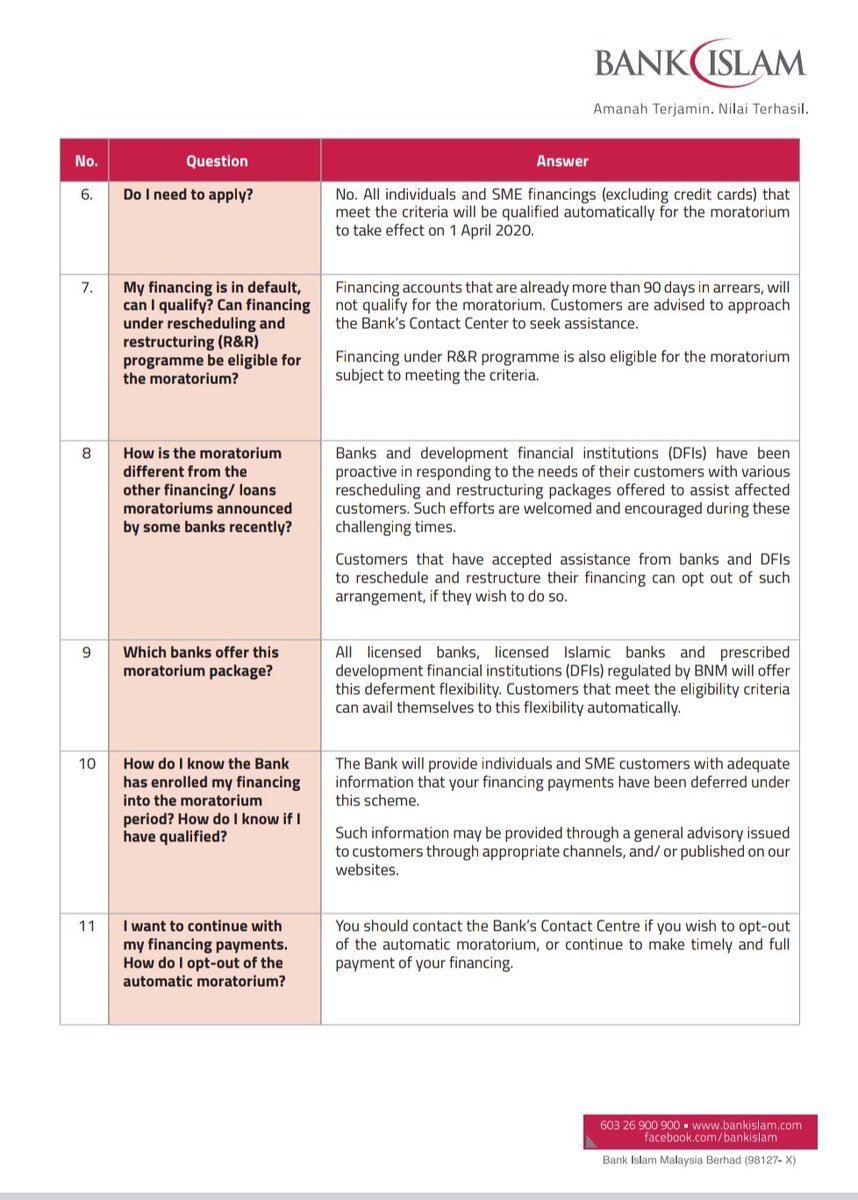

Bank Islam Malaysia has announced a six-month moratorium for customers from the B40 bottom 40 M40 middle 40 and T20 top 20 categories and the MSME segment affected by the COVID-19 pandemic Bernama reported. KUALA LUMPUR March 19 Bank Islam Malaysia Bhd has expanded its financial relief programme for customers impacted by Covid-19 which includes a moratorium for.

Namun kami sedia membantu sekiranya anda memerlukannya.

. For Islamic banks the approach on the selective moratorium policy will ensure their financial liquidity and business sustainability amid this extraordinarily challenging time. Covid-19 has brought upon us challenges that none of us anticipated before and unfortunately some have suffered greater than most he said in a statement today. Kini adalah masa yang sukar kerana ramai antara kita terkesan akibat pandemik Covid19 serta penguatkuasaan pelbagai sekatan pergerakan termasuk Perintah Kawalan Pergerakan.

The customers will continue paying the same instalment amount after the moratorium period ends. The second part of the Moratorium series will cover the moratorium assistance offered by Bank Islam. Bismillah semoga berbagai layanan untuk muslim muslimah dan seluruh WNI.

Bank Islam Trust Company Labuan Ltd. Customers under the banks House Financing Personal Financing and Vehicle Financing facilities are eligible to apply for a moratorium of up to six months. Kini adalah masa yang sukar kerana ramai antara kita terkesan akibat pandemik Covid19 serta penguatkuasaan pelbagai sekatan pergerakan termasuk Perintah Kawalan Pergerakan.

Govt Allows Another One-Off RM10K Withdrawal From EPF The Pros Cons. Please visit our 2021 Bank Loan Moratorium Guide. He added that Bank Islam has assisted more than 394000 customers since the six-month moratorium was implemented in April.

PDF On Jul 16 2020 Mohammad Mahbubi published Repayment Moratorium in Islamic Banks in Malaysia Find read and cite all the research you need on ResearchGate. Applying an automatic moratorium for all customers irrespective of their financial capabilities would deepen further the fall in Islamic banking revenues. Tempoh Moratorium Selama 2 Tahun Jika anda LAYAK Di bawah program moratorium 2 tahun ini anda sama sekali tidak akan dikenakan apa-apa tindakan daripada pihak bank selama tempoh 2 tahun jika anda gagal buat bayaran asal dan anda disarankan berbincang dengan pihak daripada masa ke semasa untuk menstruktur semula pinjaman dengan pihak bank.

Bank Islams business customers and eligible small and medium enterprises can apply for up to RM1 million in financing with a tenure of up to 55 years and a moratorium of up to six months at an affordable financing rate of 375 per cent per annum. Bank Islam Continues Post-Moratorium Assistance Until June Next Year. Program Bantuan Pembayaran.

Those who are eligible can apply for a moratorium of up to six months for the payment of their monthly commitment subject to the conditions set. Bank Islam will NEVER request for Internet Banking Account updating via e-mail or disclosure of customers personal identification number Login ID password and i-Access Code to third. This article refers to the 2020 loan moratorium and the information here may be outdated.

Bank Islam Targeted repayment assistance Applica. Namun kami sedia membantu sekiranya anda memerlukannya. Tetapi juga handal dalam melayani kebutuhan perbankan para pekerja migran Indonesia.

This Founder Started Fragrance Biz At Home Now Sell 3 Mil Units Per Month. Bank Islam Malaysia Bhd has received about 10000 applications for loan repayment moratorium extension involving the retail segment from August until. Dibawah ini adalah senarai Bank beserta dengan Link Terkini untuk info lanjut dan cara Permohonan Moratorium - Moratorium Maybank KLIK SINI Moratorium Bank Rakyat KLIK SINI Moratorium Bank Islam KLIK SINI Moratorium CIMB KLIK SINI Moratorium BSN KLI KSINI Moratorium Public Bank KLIK SINI Moratorium Ambank KLIK SINI.

RMid Rakyat Merdeka - Menteri BUMN Erick Thohir mengucap syukur atas beroperasinya Bank Syariah Indonesia BSI di Dubai International Financial Center Uni Emirat Arab UEA. BNMs Fund for SMEs. Bank Islams business customers and eligible small and medium enterprises can apply for up to RM1 million in financing with a tenure of up to 55 years and a moratorium of up to six months at an affordable financing rate of 375 per cent per annum.

Finance Minister Tengku Dato Sri Zafrul Abdul Aziz has announced that hire purchase agreements for both conventional and Shariah-compliant variants will not accrue interest. Bank Negara Malaysia has established additional or enhanced existing financing facilities to provide relief for and to support the recovery of SMEs. TEMPOH MORATORIUM SELAMA 2 TAHUN Jika anda LAYAK Di bawah program moratorium 2 tahun ini anda sama sekali tidak akan dikenakan apa-apa tindakan daripada pihak bank selama tempoh 2 tahun jika anda gagal buat bayaran asal dan anda disarankan berbincang dengan pihak daripada masa ke semasa untuk menstruktur semula pinjaman dengan pihak bank.

BANK Islam Malaysia Bhd is lending a hand to flood victims with an aim to ease their financial burden by introducing its Prihatin Programme. Bank Islam Malaysia Berhad. The moratorium is part of its efforts to help customers cushion the adverse impacts of the Covid-19 pandemic.

Arising from this the Bank Islam granted the six-month moratorium and the customers will continue paying the same installment amount after the moratorium period. We are keeping abreast with the latest news on the flooding. This program aims to alleviate the financial burden of flood victims who are customers under the facilities of Home Financing Personal Financing and Bank Islam Vehicle Financing.

In a media release dated August 2 2020 the Chief Executive Officer of Bank Islam announced that Bank Islam will initiate additional moratorium assistance following the expiry of the six-month blanket moratorium assistance. Upon the expiry of the blanket moratorium on 30 September 2020 banks in Malaysia would be focusing on targeted assistance approach specifically for individual customers who have lost their jobs in 2020 and to those individual customers who are suffering from a drop in income due to the COVID-19 pandemic. The first full-fledged Shariah compliant Labuan Trust Company incorporated under the Labuan Companies Act 1990 and registered as a Trust Company under the Labuan Financial Services and Securities Act 2010.

Bank Islam Malaysia Berhad. Following the Budget 2022 announcement the Bank is committed to further increase the allocation under the BNMs Fund for SMEs by RM45 billion.

Bank Islam Offers Moratorium For Flood Victims The Star

Moratorium Series 2 Bank Islam Properly

Permohonan Lanjutan Moratorium Bank Islam Kini Dibuka Semak Senarai Dokumen Yang Diperlukan Edu Bestari

Malaysian Banks Hold Open Days Operate On Weekends For Post Moratorium Matters

Aku Rakyat On Twitter The Faq On Bank Islam Moratorium Holiday Payment Nak Mudah Call 03 26900900 Call Center Bank Islam Bankislam Covid19 Https T Co Ikj750eowu Twitter

Semakan Moratorium Bank Islam Semakan Status Moratorium Maybank

Malaysian Banks And Local Institutions Offer Financial Assistance For Customers Affected By Covid 19

Islamic Banks Give Clarity On Moratorium The Star

Bank Islam Continues Post Moratorium Assistance

Bank Islam Bank Muamalat To Open Branches On Weekends To Assist Affected Customers

10 Bank Islam Branches To Open On Saturday To Facilitate Post Moratorium Financial Assistance

Moratorium Series 2 Bank Islam Properly

Penangguhan Bayaran Loan Bank Islam Moratorium Perlu Di Buat Secara Online Sila Isi E Borang Ini Portal Kini

Bank Islam Expands Financial Relief For Customers Impacted By Covid 19 Malay Mail

Moratorium Series 2 Bank Islam Properly

Borang Permohonan Moratorium Bank Islam Pemulih Mulai 7 Julai 2021

Bank Islam Malaysia Berhad Pelanggan Yang Dihargai Sekiranya Anda Tidak Menerima Sms Berkenaan Penangguhan Ansuran 6 Bulan Dan Ingin Pengecualian Penangguhan Bayaran Pembiayaan Anda Boleh Mengisi E Borang Melalui Pautan Berikut

Comments

Post a Comment